-

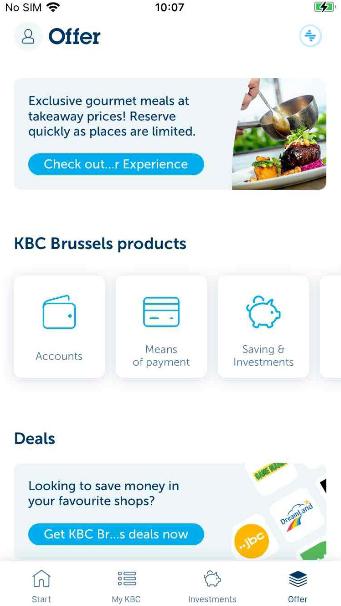

Tap ‘Offer’ at the bottom right.

-

Tap the ‘Saving & Investments’ tile under ‘KBC Brussels Products’.

-

What is offered differs for each customer. You might not be able to see all tiles in your KBC Brussels Mobile app.

-

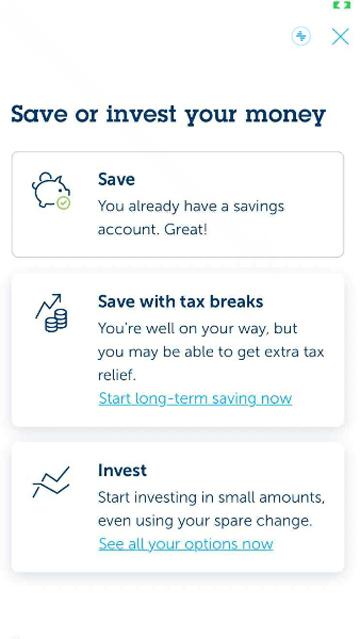

Tap the ‘Invest’ tile.

-

If you’re an experienced investor, you’ll see other options here.

-

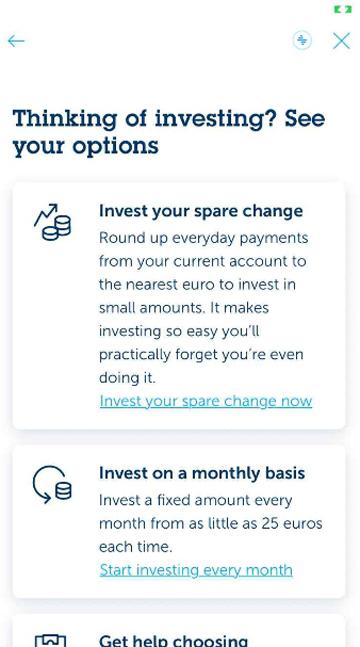

Select ‘Invest every month’.

-

Here you can read some more about why investing every month is a good idea.

-

Tap ‘Next’ to go to the next page.

-

Read through the product features and legal documents for the fund offered in this investment plan.

-

Tap ‘Next’ to go to the next page.

-

Tap one of the options to make your choice.

-

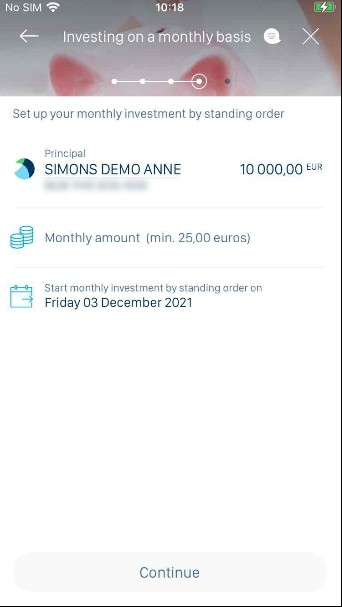

Choose how much you want to invest each month (minimum of 25 euros). You can also change the account from which this amount is deducted, as well as the date on which your monthly investment order starts.

-

Enter how much you want to invest each month.

-

Tap ‘Next’ at the bottom of the screen.

-

Here we provide you with an overview of what this investment plan costs, as well as a simulation of the charges you’d incur if you were to exit early. You can also read more about the different charges and other important information. If you’re still unsure or you have questions, contact KBC Brussels Live.

-

Tap ‘Next’ at the bottom of the screen.

-

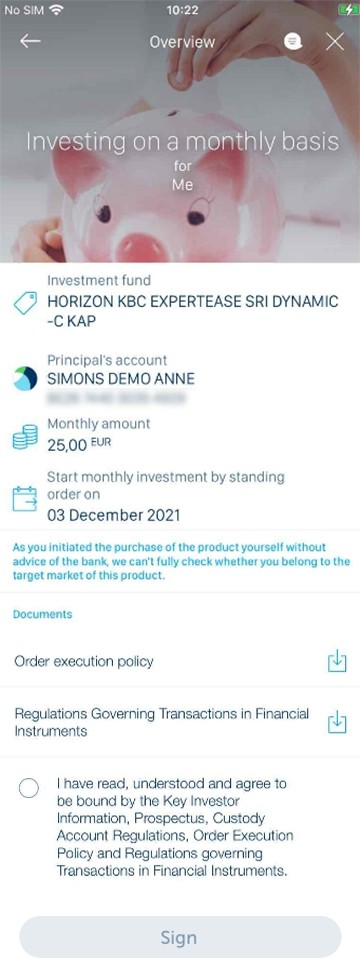

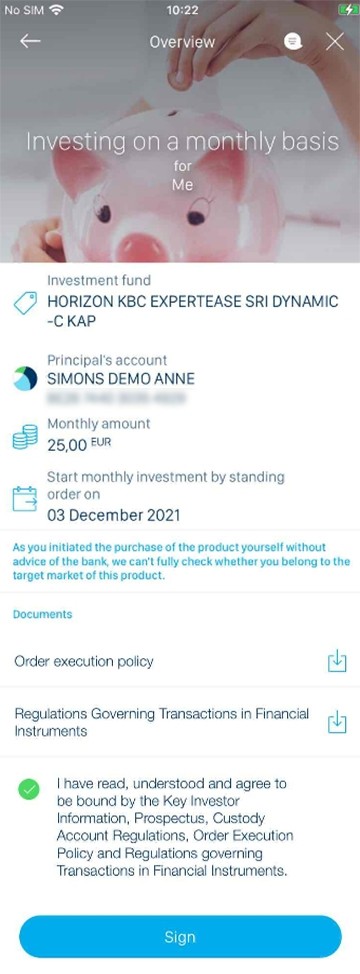

We’ll show you another overview of what you’ve selected. At this point, we also provide you with the legal documents. You’ll need to read through them before you can buy into the investment plan.

-

Indicate that you’ve read all the legal documents by selecting the checkbox.

-

Tap 'Sign' to buy into this investment plan.

-

Enter your PIN and tap ‘OK’.

-

Tap the ‘OK’ button at the bottom right.

-

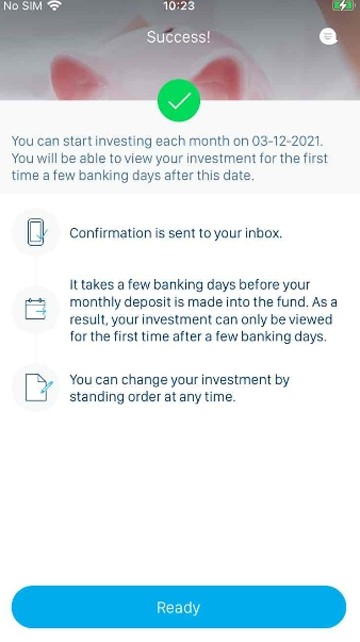

Done! You’ve now started to invest every month. Please note that it may take a few days before your investment plan appears in KBC Brussels Mobile.

-

Tap ‘Done’ at the bottom of the screen to exit.

Like to install KBC Brussels Mobile?

Scan the QR code and download KBC Brussels Mobile.

Just follow the instructions on your smartphone.