Got your card on you?

Be more enterprising with KBC Brussels's business credit card.

Whether you’re a freelance consultant, a self-employed small business owner or a company manager with employees, KBC Brussels’s business credit card gives you the freedom to be more enterprising. Whether you’re booking a hotel for a business trip, settling up after a business lunch or buying new office supplies, you can pay and withdraw cash worldwide, thanks to the extensive Mastercard network.

Specify who can use the credit card, where it can be used and when, along with a limit of your choice. The full name of the card holder will be added on the front of the card and, if necessary, the first name can be changed to the one the holder is generally known by.

- Manage the card fully digitally

Take care of your banking needs 24/7 in one of our apps. - Get more insight into managing spending

With handy monthly overviews. - Specify where the credit card can be used

Within or outside Europe (excl. US) or worldwide (incl. US). - Get through airport security checks faster

Skip the queues thanks to Mastercard® Airport Security Fast Track.

- Choose a spending limit

Apply online and choose a spending limit between 2,500 euros and 10,000 euros.

Suitable for in the business and on the go

It’s definitely worth having KBC Brussels's business credit card on you for everyday use and when you’re on the road. If you regularly need to drive or often have to travel for your business, you can use the card to pay for your stay, transport, catering, activities – and more beside, including priority access at airport security.

For the self-employed and companies

Regardless of whether you’re a business manager, freelancer or employer, any company can apply for one or more business credit cards at KBC Brussels. And if your company expands, you can request additional cards and link them to your company's KBC Brussels Business PRO Account.

Suitable for in the business and on the go

It’s definitely worth having KBC Brussels's business credit card on you for everyday use and when you’re on the road. If you regularly need to drive or often have to travel for your business, you can use the card to pay for your stay, transport, catering, activities – and more beside,

For the self-employed and companies

Regardless of whether you’re a business manager, freelancer or employer, any company can apply for one or more business credit cards at KBC Brussels. And if your company expands, you can request additional cards and link them to your company's KBC Brussels Business PRO Account.

For expected and unexpected costs

KBC Brussels’s business credit card is a convenient way for paying recurring costs such as subscriptions, online services and advertising expenses. And it also enables you to deal with unexpected costs, such as administrative expenses, fines, cash shortage and stock deficiencies.

For every budget

The KBC Brussels Mastercard Business Essential Credit Card costs 15 euros a year in addition to what you pay for a KBC Brussels Business PRO Account. There are no hidden costs or additional insurance cover. You only pay for what you really need – a reliable card that gives your company the freedom to pay for your business purchases anywhere. Plus the amount you spend doesn’t have to be paid back until the following month!

For more insight and overview

KBC Brussels’s business credit card lets you keep your business and personal purchases separate. It also reduces the administrative burden on your business. You’ll no longer need to keep loose purchase and expense receipts, as you receive billing statements each month with an overview of all transactions (per card holder).

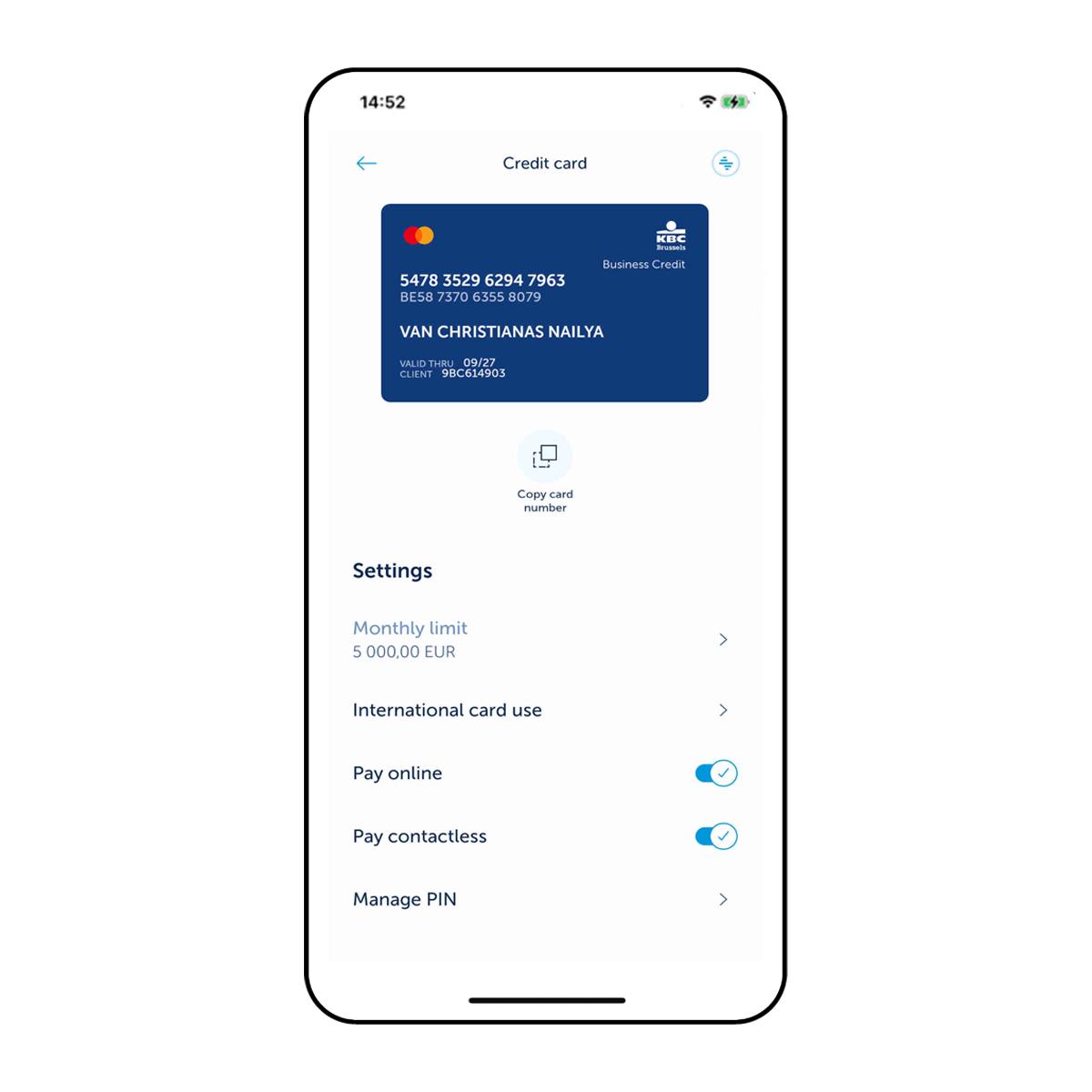

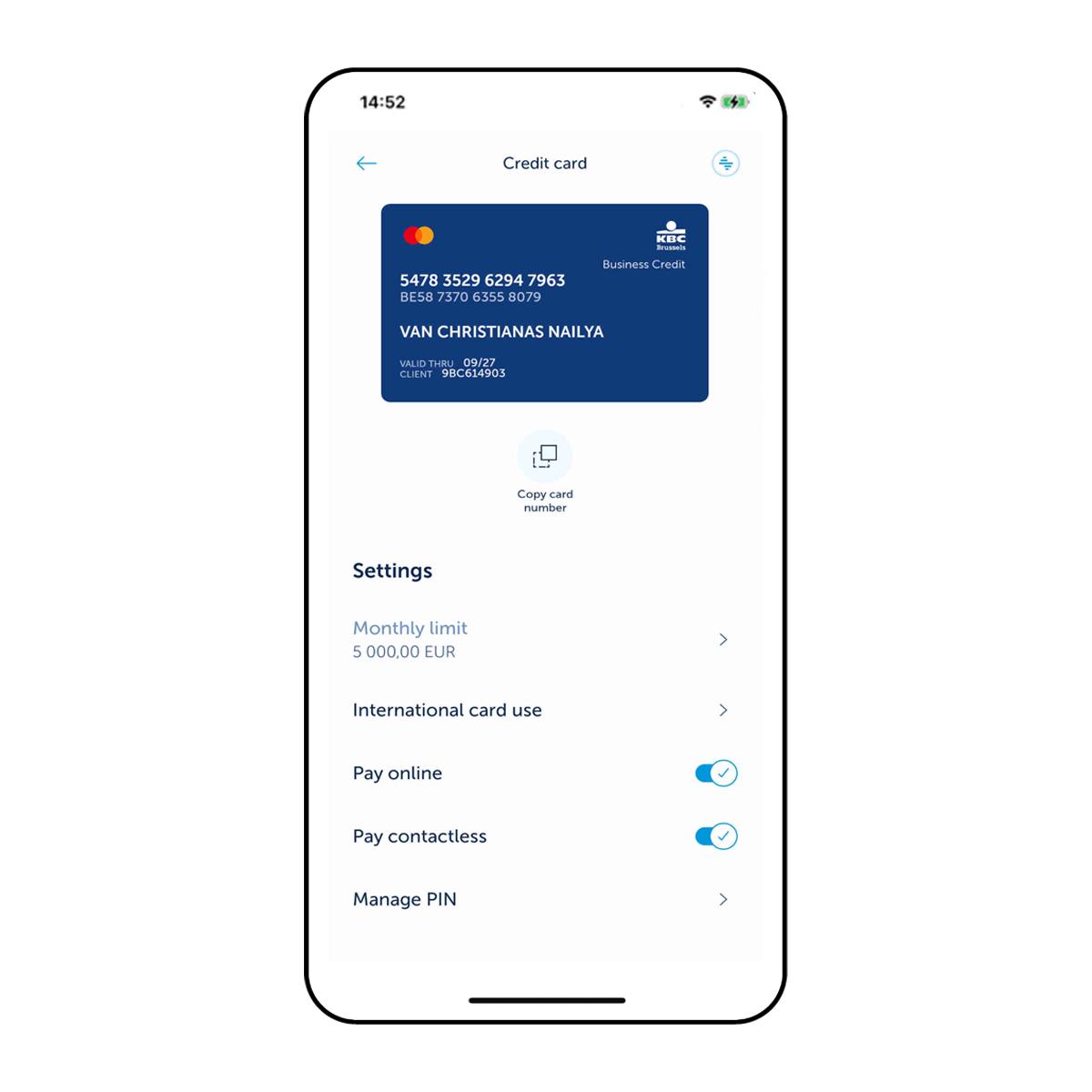

For digital management

Manage the KBC Brussels Mastercard Business Essential Credit Card in KBC Brussels Mobile, KBC Brussels Touch and the KBC Brussels Business Dashboard. For example, you can turn the contactless payment function on and off, choose whether the credit card can be used for online purchases and apply for additional cards.

For more insight and overview

KBC Brussels’s business credit card lets you keep your business and personal purchases separate. It also reduces the administrative burden on your business. You’ll no longer need to keep loose purchase and expense receipts, as you receive billing statements each month with an overview of all transactions (per card holder).

For digital management

Manage the KBC Brussels Mastercard Business Essential Credit Card in KBC Brussels Mobile, KBC Brussels Touch and the KBC Brussels Business Dashboard. For example, you can turn the contactless payment function on and off, choose whether the credit card can be used for online purchases and apply for additional cards.

Got your card on you too?

Make it easy on yourself and apply for the KBC Brussels Mastercard Business Essential Credit Card online. You’ll receive the card in the post within five business days of your application being approved.

Not a KBC Brussels customer?

The KBC Brussels Mastercard Business Essential Credit Card is linked to the KBC Brussels Business PRO Current Account. To apply for the credit card, you must first open a business current account.

Frequently asked questions about the business credit card

The KBC Brussels Mastercard Business Essential Credit Card has a standard spending limit of 3 000 euros per month. If you prefer a different one, you can choose from five limits when applying for a new card, namely 2,500 euros, 3,000 euros, 5,000 euros, 7,000 euros and 10,000 euros.

If you want to change your credit card limit afterwards – either temporarily or permanently – get in touch with a KBC Brussels branch near you or contact KBC Brussels Live.

You can link an additional credit card to your KBC Brussels Business PRO Account using KBC Brussels Mobile, KBC Brussels Touch and the KBC Brussels Business Dashboard. You can link multiple credit cards to a current account, provided your application is approved.

If you’d like an additional credit card for someone who doesn’t hold a power of attorney for your current account, get in touch with a KBC Brussels branch near you or contact KBC Brussels Live.

| KBC Brussels Mastercard Business Essential | |

| Annual fee | 15 euros (excluding the KBC Brussels Business PRO Account) |

| Paying retailers | Free of charge |

| Online transactions | Free of charge |

| Withdrawing cash at ATMs | 1% of the amount withdrawn (with a minimum charge of 5 euros) |

| Withdrawing cash in a financial institution or bureau de change | 2% of the amount withdrawn (with a minimum charge of 5 euros) |

| Several card holders | |

| Exchange rate | Indicative rate set by the European Central Bank (plus an exchange margin of 1.6% for payments and withdrawals in a currency other than the euro). |

You can use KBC Brussels Mobile, KBC Brussels Touch and the KBC Brussels Business Dashboard to:

- See your monthly billing statements

- Turn the contactless payment function on and off

- Specify where and when your card may be used (‘Europe’, ‘World excl. USA’, or ‘World’)

- Enable or disable your credit card for online purchases

- Apply for an additional credit card either for yourself or another card holder (e.g., a colleague or employee)

- Specify which staff members get billing statements and in what format (only possible in the KBC Brussels Business Dashboard)

You will receive a billing statement each month in KBC Brussels Mobile, KBC Brussels Touch and the KBC Brussels Business Dashboard. The closing date is always the 23rd calendar day of the month.

Yes, a business credit card is linked to your company and a business current account. You can combine the KBC Brussels Mastercard Business Essential Credit Card with the KBC Brussels Business PRO Current Account.

You are protected against card fraud. No insurance policies are linked to the credit card.

You can use the KBC Brussels Mastercard Business Essential Credit Card to pay anywhere in the world accepting Mastercard. All you have to do is enter your PIN or add your signature, including online whenever the website features the ‘MasterCard Secure Code’ logo. Of course, you can also make contactless payments by holding your card against the payment terminal.

If you need cash, you can use your card at any ATM displaying the Mastercard logo, anywhere in the world. In countries outside the European Monetary Union, you automatically get a good exchange rate. You can withdraw up to 620 euros in cash (at an ATM) every four days.

Remember that withdrawing cash and paying abroad with your card can sometimes attract charges.

The KBC Brussels Mastercard Business Essential Credit Card is linked to a KBC Brussels Business PRO Current Account. If you’ve opened such an account, you can apply for your credit card online in KBC Brussels Mobile, KBC Brussels Touch and the KBC Brussels Business Dashboard:

In KBC Brussels Mobile:

- Log in

- Tap ‘My KBC Brussels‘ at the bottom of the screen and then ‘Business’ at the top

- Scroll to ‘Means of payment’ and tap ‘(+) New’

- Select ‘Business credit card’

- Select your business current account and then tap ‘KBC Brussels Mastercard Business Essential’

- Follow the instructions

You can also get Kate to help you. Your digital assistant can be found in the top-right corner of KBC Brussels Mobile. Tap the icon and type: ‘I want to apply for a business credit card’.

In KBC Brussels Touch:

- Log in

- Select ‘Business’ at the top left of your screen

- Go to ‘Payments’ and tap or click ‘(+) New’ next to ‘Credit Cards’

- Select the current account to which you want to link your credit card

- Select ‘KBC Brussels Mastercard Business Essential’

- Follow the instructions

In the KBC Brussels Business Dashboard:

- Log in

- Go to ‘Cards’ and tap or click ‘New credit card’

- Select the current account to which you want to link your credit card

- Select ‘KBC Brussels Mastercard Business Essential’

- Follow the instructions

The closing date for all transactions on your credit card is the 23rd of each month. The amount to be repaid is debited from your KBC Brussels Business PRO Current Account automatically nine calendar days later.

Mastercard® Airport Security Fast Track is a service that gives you preferential access to a dedicated lane straight to the security checkpoint, allowing you to skip queues. To use this service, check in with your KBC Brussels Mastercard Business Essential Credit Card.

More information is available on Mastercard's website.