Ah, life. All sorts of expenses to pay for and things to think about. That's why at KBC Brussels we believe in moving forward together. Kate Coins enable you to earn money at both KBC Brussels and our partners. It doesn’t get much better than that! Discover how to save time and earn money in KBC Brussels Mobile!

Kate Coins in the spotlight: Bioracer

Stay totally comfortable in the saddle this spring with Bioracer's top-quality cycling gear! Thanks to Kate Coins, you can now grab a cashback reward worth 10 euros when you spend 100 euros or more.

- Thanks to your Kate Coins in KBC Brussels Mobile, you can get tidy cashback rewards at KBC Brussels or our partners.

- You can not only get Kate Coins from KBC Brussels or our partners, you can earn Kate Coins too when you buy certain products from KBC Brussels or our partners.

- The range of Kate Coin offers is constantly growing, so keep checking KBC Brussels Mobile to see what’s new!

- 1 Kate Coin is worth 1 euro*.

- If you’re looking for your Kate Coins, just ask Kate!

* Kate Coins cannot be exchanged for cash. A Kate Coin loses its value once the specific Kate Coin offer has ended.

Discover what you can do with your Kate Coins

Monthly investment plan at KBC Brussels

Start building up your savings each month. Set up a monthly investment plan with 25 Kate Coins and get 25 euros cashback.

This offer is only valid if you’ve opted for ‘Personalised’ in KBC Brussels Mobile.

LensOnWeb

You now get 50 Kate Coins that you can use immediately for 10% cashback in the LensOnWeb online shop, up to a maximum total value of 50 euros.

This benefit is valid up to and including 1 april 2025, if you’ve opted for ‘Personalised’ in KBC Brussels Mobile'. All terms and conditions can be found in KBC Brussels Mobile.

Opt for ‘Personalised’ to receive Kate Coins from our partners

If you’ve opted for ‘Personalised’ commercial offers in KBC Brussels Mobile, you can receive or earn Kate Coins from participating partners and have access to lots of additional features. If you haven't opted for ‘Personalised’ yet, ask Kate about it now.

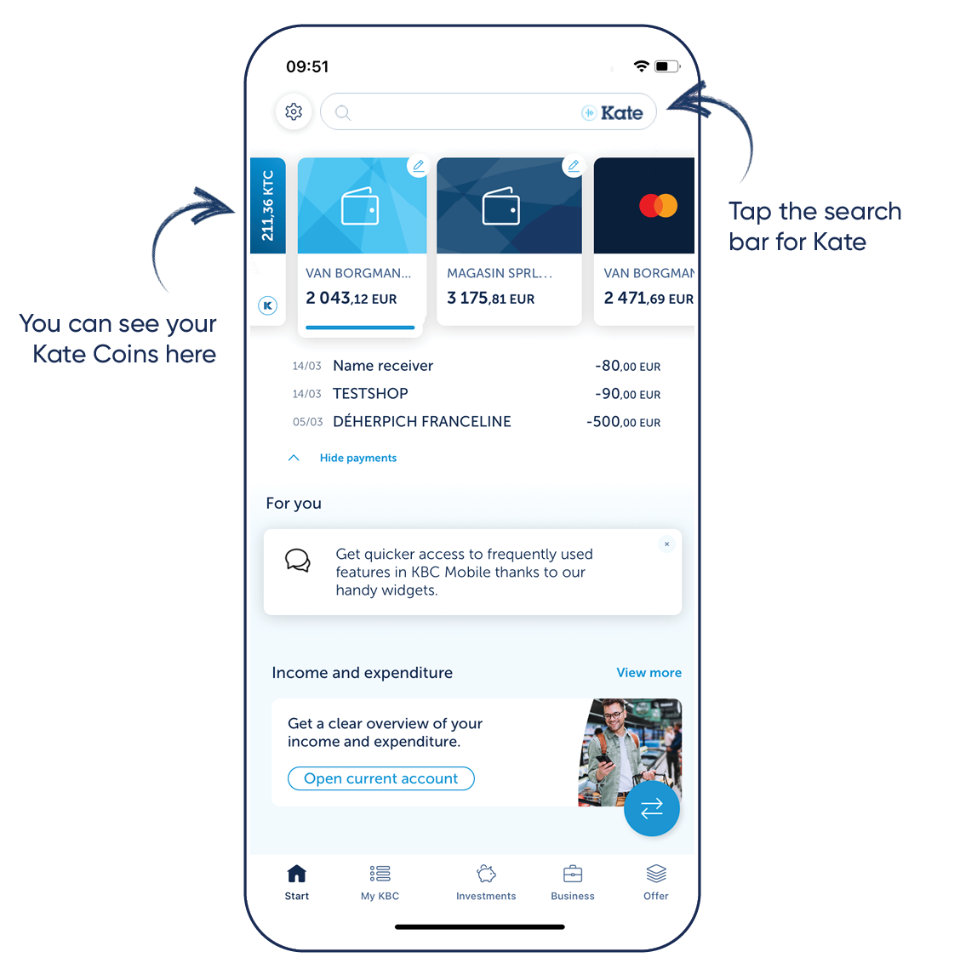

Where can you find Kate and Kate Coins?

- Just tell Kate: ‘Show my Kate Coins’.

- Kate will show you an overview of all your options. You can learn more about what Kate Coins are, see your balance, and find out how to receive and use your Kate Coins.

- Or tap the tile on the far left in your KBC Brussels Mobile

Frequently asked questions

It can take up to 24 hours before your Kate Coins appear in your wallet.

There are two types of Kate Coins at KBC Brussels.

- General use: you can choose which benefit you want to spend your coins on

- Specific use: you can only redeem these Kate Coins for a specific benefit

For participating partners, you can use Kate Coins specific to that partner.

Kate Coins from KBC Brussels are valid for one year. The period of validity for Kate Coins from our partners varies on a case-by-case basis, so you should check the terms and conditions for each partner.

KBC Multi-Trip Travel Insurance is a form of property damage insurance provided by KBC Insurance.

What’s covered?

Personal assistance cover mainly covers health problems while travelling (such as illness or accidents) and the inconvenience they can cause (hospitalisation, repatriation, forced extended stays, transfer of family members, etc.). Medical expenses incurred abroad are covered for up to 500 000 euros per person. The amount you pay towards medical expenses (deductible) is 100 euros.

Cancellation cover (worldwide) reimburses you for the costs you cannot recover or have to incur if you have to cancel your trip unexpectedly or return home early. Valid reasons for this are:

- Health-related reasons (such as illness, an accident or death)

- Work and study (such as examination resits, dismissal, etc.)

- Government and travel formalities (such as a call for jury duty or a travel warning or travel alert issued by the Belgian Ministry of Foreign Affairs after the trip was booked, etc.)

- Missed aeroplane, boat or train (unexpected delay of the booked transport by at least 48 hours, etc.)

Compensation is capped at 12 500 euros per trip for all insured persons combined.

Luggage cover insures the following:

- Theft, damage to your luggage and loss of your luggage by the transport company

- While travelling, you are covered for theft involving personal violence or threats of personal violence, theft following a break-in to a vehicle or the place where you are staying, and damage or destruction caused by a sudden and unexpected event, such as a collision

We insure the luggage you have with you on your trip as well as sports equipment, non-motorised vehicles, boats and riding animals you rent or are allowed to use for free while travelling, up to the value of 1 500 euros per insured person.

A deductible of 100 euros per claim is deducted from the compensation provided. This deductible does not apply to claims resulting from rendering assistance to persons in distress.

Travel accident cover provides compensation if you sustain permanent injuries or die. If you die within three years as a result of the accident, we pay compensation of 10 000 euros to the cohabiting partner, or if there is no partner, we divide this sum among the heirs. We also reimburse the funeral expenses actually incurred up to an amount of 10 000 euros. Payment is made to the person who incurred these expenses.

In the event of a permanent disability, we pay compensation calculated on the basis of the degree of disability as specified in the ‘Officiële Belgische Schaal ter bepaling van de Graad van Invaliditeit’ [Official Belgian scale for determining the degree of disability]. You receive 5 000 euros per commenced bracket of 5% on this scale. For example, we pay 50 000 euros for a 50% degree of disability and 55 000 euros for a 51% degree of disability. A degree of disability less than 6% is not covered. A permanent disability of at least 67% is equivalent to full physical disability, in which case you would receive 100 000 euros.

Travel disputes cover provides you with legal assistance and support while you are travelling, or in relation to the trip you have booked. Events covered include disputes with tour operators, rental companies, repair companies and other service providers, problems involving the police and government authorities abroad. The above costs are covered up to an amount of 50 000 euros per claim for all the insured combined. Our own management fees are not included.

What are the main exclusions?

Under Personal assistance cover: complications occurring after the sixth month of pregnancy and the costs associated with childbirth, complications or worsening of an existing illness if the prescribed treatment has not been followed, participation in professional sporting activities (including training for such sports) and participation in extreme outdoor activities.

Under Cancellation cover: events you were already aware of before you booked the trip or took out the insurance that mean that the cancellation is not unexpected, complications or worsening of an existing illness that can be regarded as a normal part of the illness, which were known when you booked the trip.

Under Luggage cover: damage to your luggage caused by use, cleaning, treatment or repair, and damage you cause intentionally.

Under Travel accident cover: accidents that occur as a result of participation in extreme outdoor activities, such as base jumping, heli-skiing or wreck diving, and participation in professional sporting activities (including training for such sports).

Under Travel disputes cover: disputes between individual insured persons, travel for medical purposes and scheduled medical treatment outside Belgium and the potential resulting complications or additional treatment required in Belgium, and time-shares.

You can take out the personal assistance cover, luggage cover, extra-protection travel accident cover and travel disputes cover up to a day before your departure date. Cancellation cover must be taken out at least one month before the departure date.

Complaints about your insurance

Your intermediary is the first point of contact for any complaints you may have. If no agreement can be reached, please contact KBC Complaints Management at complaints@kbc.be. If you cannot find a suitable solution, you can contact the Belgian insurance industry's ombudsman service, Ombudsman van de Verzekeringen: info@ombudsman-insurance.be, www.ombudsman-nsurance.be. This does not affect your legal rights.

Useful information about your travel insurance

All of these products are governed by the laws of Belgium. The insured persons must reside in Belgium and have their principal residence there.

You can easily take out personal assistance cover, luggage cover and extra- protection travel accident cover online – even up to the day before you depart. Travel disputes cover cannot be taken out online. Cancellation cover must be taken out at least one month before the departure date.

Contact your insurance expert or visit our website to request a quote for KBC

Multi-Trip Travel Insurance.

The product fact sheets and the General Conditions can be consulted on the KBC Brussels website. Be sure to read this information carefully before taking out the insurance. The different forms of cover in these policies apply for a term of one year and are tacitly renewed unless they are cancelled no later than three months before the main renewal date.

KBC Insurance NV, Professor Roger Van Overstraetenplein 2, 3000 Leuven, Belgium, VAT BE 0403.552.563. RLP Leuven. Company licensed by the National Bank of Belgium, de Berlaimontlaan 14, 1000 Brussels, Belgium, for all classes of insurance under code 0014 (Royal Decree of 4 July 1979, Belgian Official Gazette of 14 July 1979). Member of the KBC group.