You can use KBC Brussels Touch on your computer or tablet. The app explains things step-by-step from the outset, but here’s a handy guide to help you get off to a flying start.

What do you need?

- Your debit card

- Your scanner-equipped card reader

You can now also use the itsme app to log in to Touch for the first time on a desktop computer.

KBC Brussels Touch on your computer

- Select ‘Log in’ at the top right on our website, then 'KBC Brussels Touch'

- Confirm that you have the required debit card and card reader

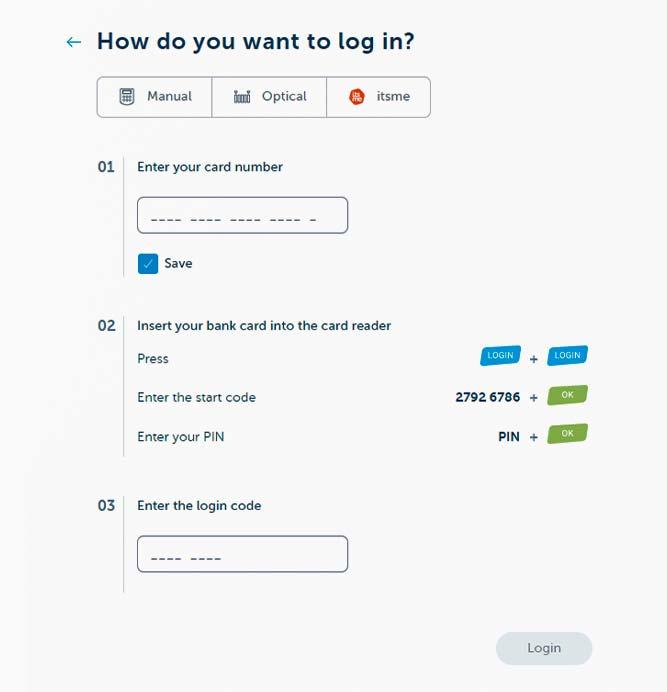

The following screen will appear.

Using your KBC Brussels Debit Card and KBC Brussels card reader

Enter your card number on your computer screen (and save it so you don’t have to enter it again)

Insert your debit card (chip first) into the card reader, then press 'LOGIN' twice in succession on the card reader

Enter the 8-digit start code you see on screen on your card reader and press 'OK' (‘PIN?’ should now appear on your card reader's display)

Enter your debit card PIN on your card reader and press 'OK' to generate your unique 8-digit login code on your card reader’s display

Enter this code in the relevant field on your computer screen and hit 'Log in'

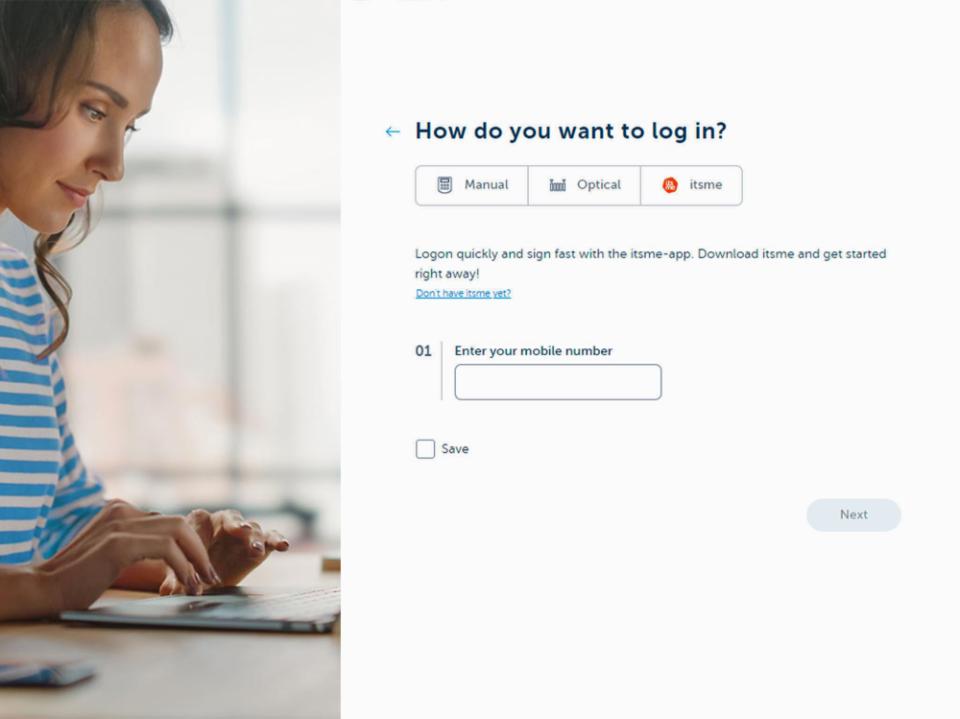

Using the itsme app

Enter the mobile number you use for itsme (and save it so you don’t have to enter it again)

Hit ‘Next’

Check your itsme app for the action sent to it

Confirm the action using your itsme app

Never divulge your codes/PIN over the phone.

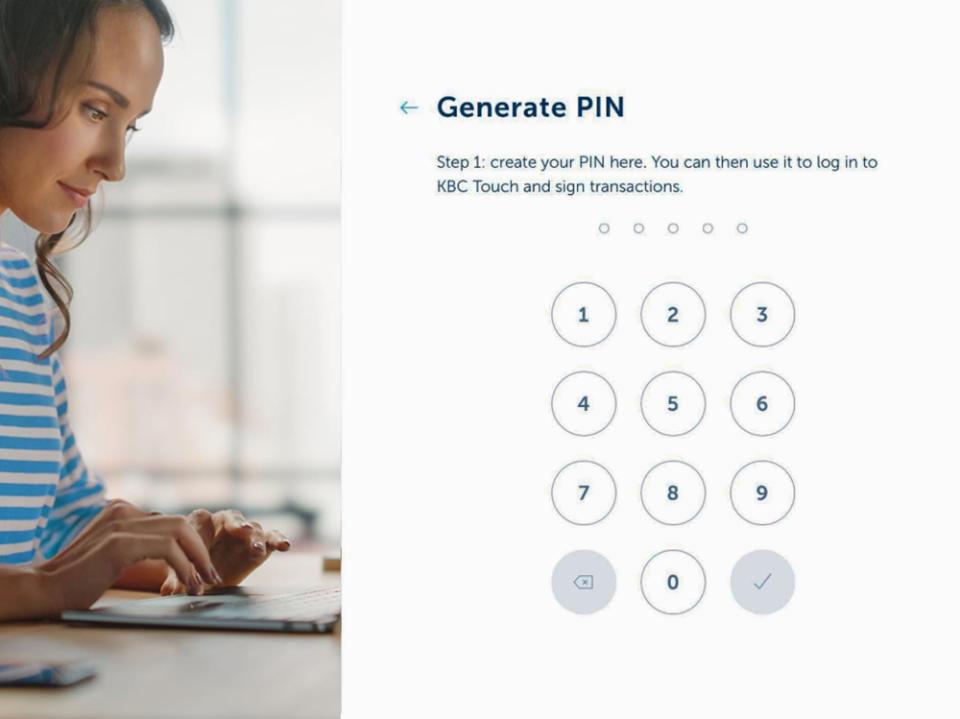

KBC Brussels Touch on your tablet

Logging in to KBC Brussels Touch on your tablet only requires your card reader the first time you log in (as described under ‘KBC Brussels Touch on your computer’ above). The first time you log in, this screen appears. Enter a 5-digit PIN of your choosing there and confirm it.

Remember this PIN as it now lets you log in and sign securely on your tablet without needing your card reader. Your 5-digit PIN also lets you authorise credit transfers of up to 1,000 euros, once again, without having to use your card reader. Transfers for larger amounts require your debit card and card reader.

Security

Security is a top priority for us, especially when it comes to online banking and insurance. That’s why KBC Brussels Touch has security software that protects you against hackers and viruses on your computer and tablet.

The 5-digit PIN on your tablet is just as secure as your card reader, since logging in is only possible using the personally chosen PIN registered in your name. If you enter an incorrect PIN three times in a row, you’ll have to register again using your card reader and debit card. Another security feature is automatic logout after a few minutes of inactivity. Stay alert at all times and never divulge your personal details or PINs to anyone.

Like to know more? See how to bank safely and securely.

Find out more about KBC Brussels Touch

See all our Touch online banking service can do for you at www.kbcbrussels.be/touch. Get help logging in or ask us a question by calling our KBC Brussels Helpdesk on 02 303 31 73.