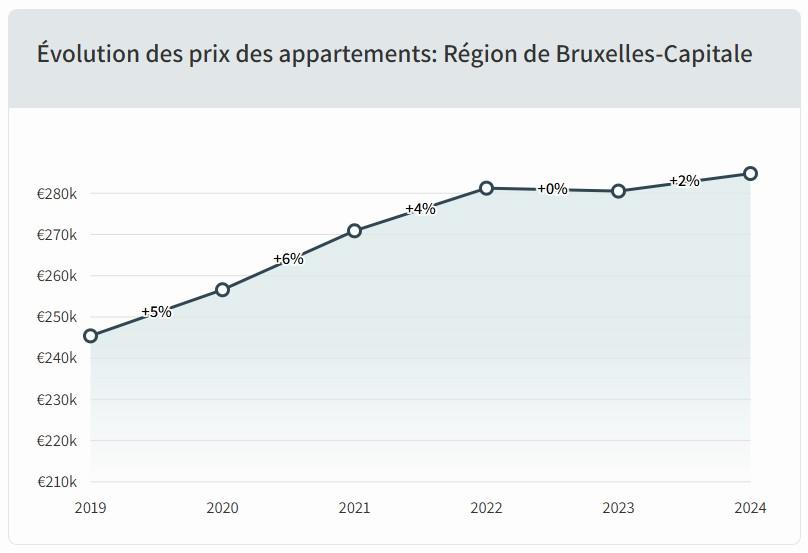

After a sharp fall in the number of real estate transactions in 2023 (-15%), the Notary Barometer for 2024 (Fednot) indicates that the situation is stabilising in terms of both the number of transactions (-0.7% nationally, +0.3% in Brussels) and average prices. Residential house prices rose by 2.2% in the country as a whole, and by 1.4% in Brussels, while apartment prices were up by 2.3% (Belgium) and 3.7% (Brussels). It is worth noting that the reduction in stamp duty announced in Wallonia on 1 January 2025 (3% instead of 12.5%, subject to certain conditions) did create a waiting effect.

Market prices in Brussels

The number of sales in Brussels recovered very slightly to +0.3% in 2024, with 70.3% of the market dominated by apartment sales, and the average age of buyers fluctuating around 40. After a steep decline in 2023, 2024 has seen an improvement in the situation. This comes at a time when many people in Brussels are turning their attention to Flanders and Wallonia due to attractive low rates of stamp duty: 3% in Wallonia, and 2% in Flanders (provided it is the owner’s or owners’ sole property, is designated as their main home and remains occupied for at least 5 years, among other conditions).

The average price of a house in 2024 was 329,743 euros in Belgium (+2.2% vs. 2023) vs. 570,110 euros in Brussels (+1.4% vs. 2023).

For apartments, average prices in 2024 rose to 271,330 euros for Belgium (+2.5% vs. 2023) and 290,763 euros in Brussels (+3.7% vs. 2023). It is important to note that the price differences between regions are continuing to narrow, although the average price of apartments with three bedrooms remains significantly higher in the capital.

In terms of municipalities, Woluwe-Saint-Pierre is in first place with an average house price of 789,476 euros, followed by Uccle and Ixelles. The same three also top the ranking for apartment prices.

For more detailed information on property prices in Belgium, view the notary barometer (only available in Dutch and French).

Real estate price trends in Brussels

House prices

Appartment prices

Average house prices in Brussels

| Commune | Price | |

| 1 | Woluwe-Saint-Pierre | € 789,476 |

| 2 | Uccle | € 749,707 |

| 3 | Ixelles | € 679,477 |

| 4 | Watermael-Boitsfort | € 640,606 |

| 5 | Woluwe-Saint-Lambert | € 640,268 |

| 6 | Etterbeek | € 605,548 |

| 7 | Auderghem | € 576,220 |

| 8 | Saint-Gilles | € 570,409 |

| 9 | Forest | € 553,239 |

| 10 | Bruxelles | € 518,622 |

| 11 | Schaerbeek | € 473,148 |

| 12 | Ganshoren | € 435,617 |

| 13 | Berchem-Sainte-Agathe | € 417,688 |

| 14 | Jette | € 410,463 |

| 15 | Evere | € 374,839 |

| 16 | Anderlecht | € 369,959 |

| 17 | Molenbeek-Saint-Jean | € 357,370 |

| 18 | Koekelberg | N.A. |

| 19 | Saint-Josse-Ten-Noode |

N.A. |

Source: notaire.be

Average appartment prices in Brussels

| Commune | Price | |

| 1 | Woluwe-Saint-Pierre | € 368,831 |

| 2 | Uccle | € 365,657 |

| 3 | Ixelles | € 350,830 |

| 4 | Woluwe-Saint-Lambert | € 348,868 |

| 5 | Etterbeek | € 337,240 |

| 6 | Auderghem | € 302,700 |

| 7 | Saint-Gilles | € 301,643 |

| 8 | Forest | € 295,930 |

| 9 | Bruxelles | € 293,620 |

| 10 | Watermael-Boitsfort | € 276,429 |

| 11 | Schaerbeek | € 262,737 |

| 12 | Evere | € 250,661 |

| 13 | Jette | € 237,461 |

| 14 | Saint-Josse-ten-Noode | € 233,933 |

| 15 | Berchem-Sainte-Agathe | € 212,346 |

| 16 | Ganshoren | € 210,721 |

| 17 | Koekelberg | € 209,570 |

| 18 | Anderlecht | € 206,079 |

| 19 | Molenbeek-Saint-Jean | € 204,626 |

Source: notaire.be

How about rents?

Not much information is filtering through on rents in Brussels in 2024. Based on the latest average figure published by the Federia real estate federation, which was 1,188 euros in 2023, average rents should be around 1,200 euros in 2024, taking indexation into account.

Most rented properties in Brussels are apartments (90%). There are still very marked price differences between the north and south of the region. The difference can be up to 500 euros between municipalities, with Woluwe-Saint-Pierre still the most expensive municipality.

Looking at the latest news, it is worth noting the obligation (temporarily, pending a court decision) to register leases twice, with both federal and regional authorities! Since 6 January 2024, tenants in Brussels now also have a pre-emptive right when the property they are renting is sold. This means that the owner is now obliged to offer the property to the tenant, who is free to make use of this pre-emptive right if they wish.

How to buy?

Would-be buyers have several options: private sale, public sale or online sale.

In the case of a private sale, the vendor and buyer agree the price of the property, at which point the sale is fixed. They sign a preliminary purchase agreement which, following the necessary checks, is then finalized in a notarial deed. On top of the agreed purchase price, the buyer has to pay registration duties (12.5% in Brussels), as well as notary’s fees and administrative costs, making a total of 14–15%.

Public and online sales (www.biddit.be) are auctions overseen by a notary. If accepted by the seller, the highest bid seals the purchase. Once again, you have to add a flat fee of about 14–15% to the purchase price. Not only are sales like this safe and free of surprises, they also have the advantage of being simpler and faster (in the case of an online sale, it only takes a few weeks to become the new owner).

One thing you always have to keep in mind is that, regardless of your chosen formula, as soon as you sign a preliminary agreement or submit an offer, you are making a binding commitment to the vendor. So before you embark on this adventure, you really need to know how much you can afford.

If you use the online simulation tool offered by KBC Brussels, you’ll know in just 15 minutes whether or not your project is affordable:

How to finance your purchase?

Even if you have your own funds, it is always advisable to finance at least part of your purchase through a loan (in the shape of a mortgage). This has several advantages:

- You retain a financial buffer to deal with unexpected events or investment opportunities.

- The interest payments on your mortgage loan are tax-deductible.

- Interest rates are still affordable

As the Brussels experts, we can offer you personalized advice on the best KBC Brussels mortgage to finance your purchase of a property in the capital.

Grants and subsidies in Brussels

Various forms of assistance are in place to help you achieve your property plans in Brussels. Each one depends on your specific situation and the nature of your project. The main ones are set out below:

Stamp duty reduction for the first 200,000 euros

Subject to certain conditions, you can receive a stamp duty reduction on the first 200,000 euros of the property price. That means you will not have to pay the 12.5% stamp duty on this tranche, a saving of 25,000 euros. To qualify, the property must be located in Brussels, you must occupy it as your main residence for five years, as a natural person, you must not own any other property, and the price must be no higher than 600,000 euros.

More info: Stamp duty reduction– Brussels Taxation (fiscalite.brussels) (French)

Renolution: a grant scheme on borrowed time?

Since March 2022, several changes have been made to the energy, renovation and exterior improvement grants, which have now been merged into a single system called “Renolution” grants, which can be accessed via IRISbox, the Brussels-Capital Region’s online platform.

In 2024, however, the future of these grants has been looking uncertain. Due to a significant budget overrun, they were stopped and afterwards restarted, but only for ongoing projects. In February 2025, pending the formation of a new Brussels government, the future of Renolution grants is still uncertain and they have been suspended.

More information on Renolution website (French/Dutch)

Reduced VAT for demolition/rebuilding

On 1 January 2024, definitive new VAT rules entered into force throughout Belgium.

The reduced 6% VAT rate now applies only to property work in relation to the demolition of a building and the rebuilding (or first-time building) of a residential building on the same plot, for use as the project owner’s own home or for social housing. The “social conditions” that must be met, for either five or fifteen years, under the temporary rules to qualify for the reduced VAT rate (building must be the sole dwelling owned by the project owner, have a habitable area not exceeding 200 m2, and be your home, or a residential building for social housing rental) remain in force under the definitive rules.

More info: new measure for demolition-rebuilding (French)